|

| The Matrix |

Full subscription provides full access to the Matrix. The Matrix updates daily.

A Limited or Free Subscription provides full access to an evaluation Matrix. It's updated periodically.

Matrix (Click Link)

"Nasdaq investor sentiment is worse now than it was in MARCH 2020."

— Macro Charts (@MacroCharts) January 21, 2022

"That’s an extremely aggressive bearish posture." (Bottom 1.8% of ALL days since 2000)

"Bearishness has fallen to such an extreme that it supports a significant stock market rally."

Source: Mark Hulbert pic.twitter.com/YbDxvjMWeU

Subscriber Comments

The same source suggested a great buying opportunity at higher price when different contrarian indicators with limited trading history produced similar buy signals.

Be careful what you follow. More importantly, be careful what you believe. The problem with contrarian indicators is perspective.

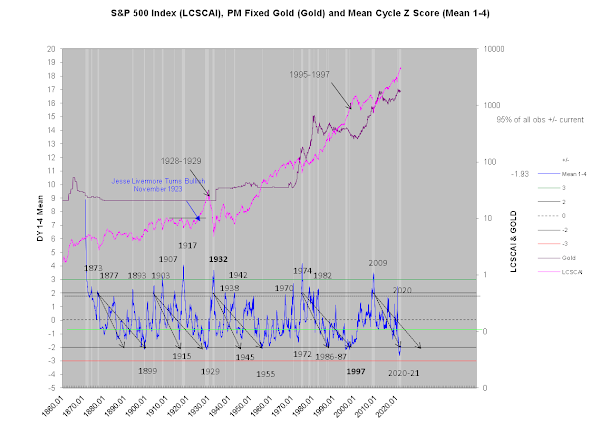

The longer term picture, an ongoing discussion in the $100 Economic & Stock Report, provides a different perspective. The risks of buying the dip are extremely high. The Dividend yield cycles, for example, describe risks not seen since 1927-1928 and 1986. Please watch the Economy & Stock Market Report video for further discussion.

Dividend Yield Cycles 1-4 Mean

Markets to watch: #sugar and $ATR.

The 2022 key is activate. All Report keys still published in Series 1 and Series 2 remain active.

The $100 Economic & Stock Report could be the most important report of 2022. The price is $50 until the end of the month.

$AAPL $AMZN $ATR $BABA $CAT $EBAY $FB $GE $GOOG $NFLX $NVDA $PAAS $TSLA $UUUU

----------------------------------

The Matrix provides market-driven trend, cycles, and intermarket analysis.